Other links

- About us

- BlogsNEW

- Contact us

- CareersCOMING SOON

Industry

Services

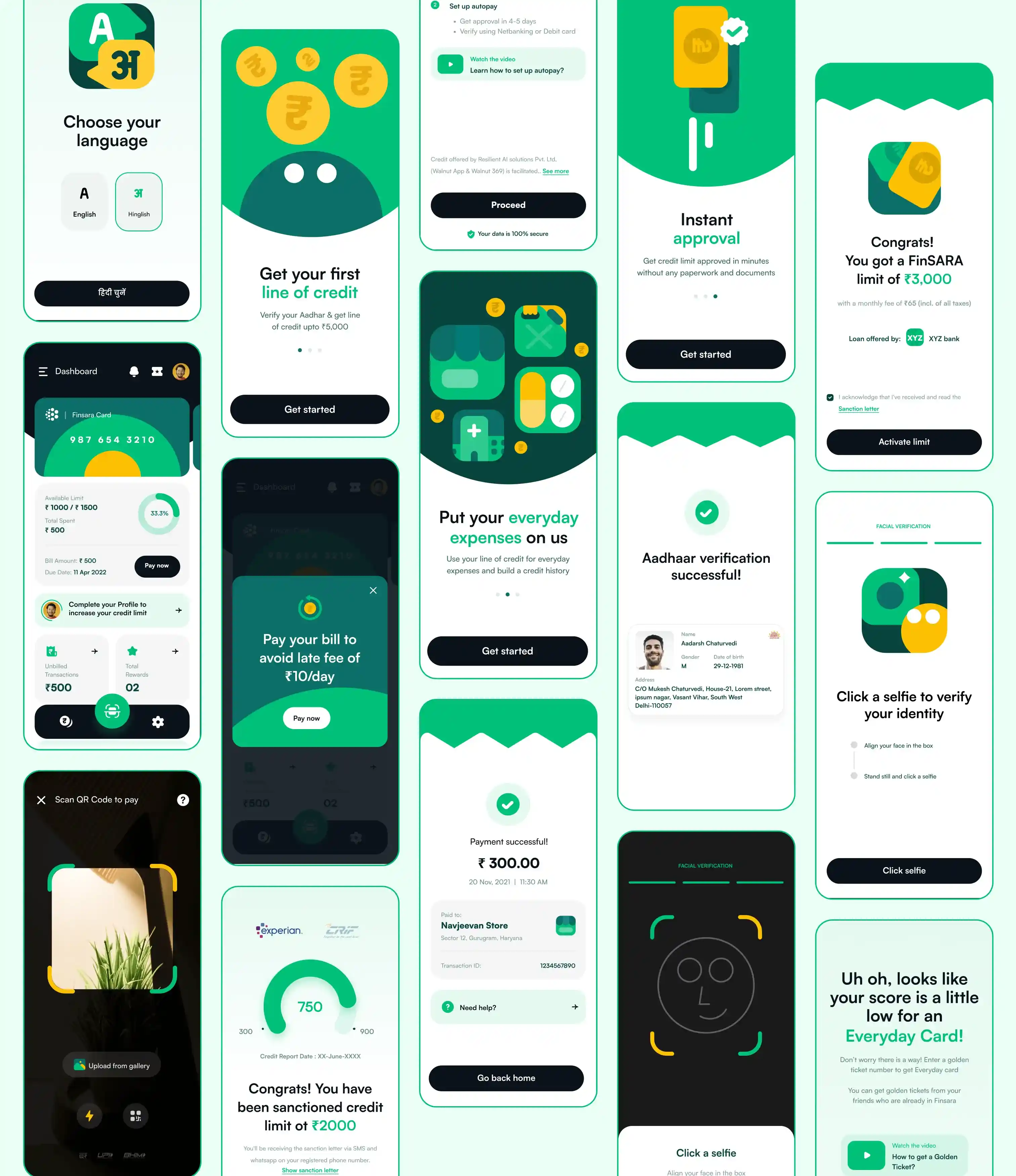

Finsara is a forward-thinking financial services startup based in India. They are on a mission to provide accessible credit solutions to underserved populations and empower them to establish a credit history.

Cultural Diversity: India's diverse culture requires a design that resonates with various regions, languages, and traditions while maintaining a universal appeal. Financial Literacy: Addressing the varying levels of financial literacy among users, ensuring simplicity, and providing education within the product. Trust Building: Overcoming skepticism around financial products and establishing trust, especially among those new to credit. User Accessibility: Ensuring the platform is accessible to users with varying tech savviness and different devices.

The app is made in a way that represents various segments of the Indian population, considering factors like age, language, and tech proficiency.

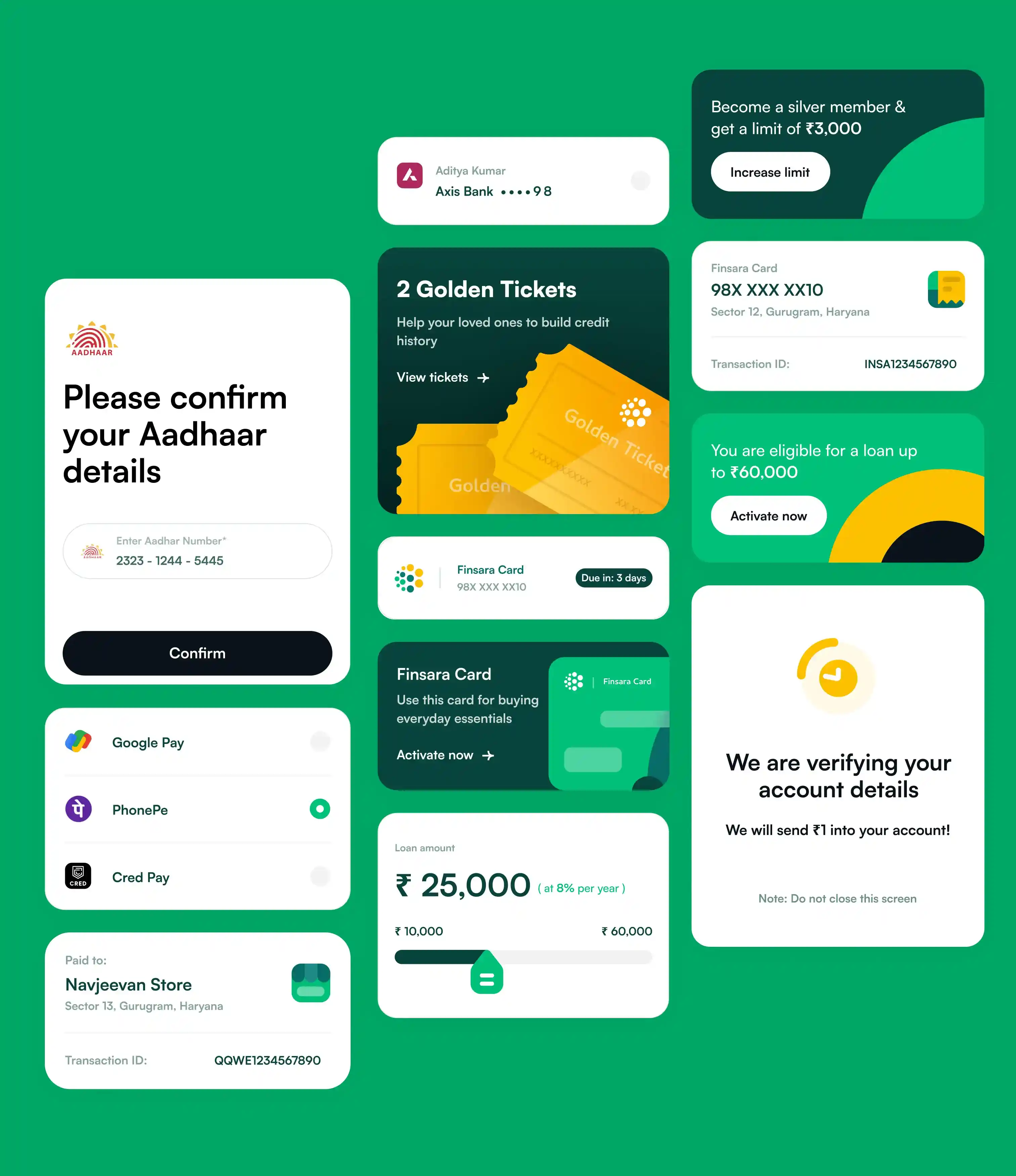

We made sure the brand is scalable enough to support multiple languages commonly spoken in India. We creation of design assets for marketing and promotional materials play an important factor in connecting with the tier 2 and tier 3 places. The user interface is intuitive, user-friendly for a digital interface of a credit product. The quick & hassle-free onboarding process makes it easy to get access to quicker credit. We had an intensive process to sketch out and develop culturally relevant icons, images, and color schemes inspired by India's diverse heritage.

After the product launch the company saw a tremendous growth in user acceptance. The platform has over 100K+ downloads in less than a year and empowered people with easy access to micro-loans and credit history building.

Client

Project team